Reputable credit brokers

In the financial world, there are numerous black sheep who offer dubious services. One of the most important tasks of credit brokers is to provide consumers with transparent credit information as part of the credit search and lending process in order to protect them from excessive or risky loans and prevent them from falling into a debt trap.

The Federal Consumer Credit Act, or KKG for short, is an important legal basis in Switzerland to ensure that borrowers are protected from such financial overcharging. Credit brokers in Switzerland are subject to strict guidelines designed to ensure that consumers are protected from any unfair practices.

In particular, the charging of fees in the context of credit brokerage plays an important role here. But what exactly does Swiss federal law say about consumer credit? What are the characteristics of a reputable credit broker and which bank is the best for a loan? You can find out all this and more in this article.

Swiss federal law: reputable credit brokers do not charge any fees

The revised Swiss Consumer Credit Act (KKG), which regulates various aspects of consumer credit for private individuals, has been in force since January 1, 2003. Among other things, the law deals with various types of credit, exceptions, contract content, the assessment of creditworthiness, the borrower’s right of withdrawal, and the regulation of credit brokers. It also defines measures to combat unfair competition and strengthen consumer protection.

In Switzerland, no fees may be charged for the mere brokerage of loans. If a company in this sector nevertheless intends to charge you fees for a personal loan, you should simply look around for a reputable provider who knows the legal situation and complies with it.

Federal law prohibits fees for credit brokerage

The facts in black and white: According to the Federal Consumer Credit Act 221.214.1, no fees may be charged when arranging a personal loan. This law serves to protect borrowers and Article 35 of the Consumer Credit Act further specifies the matter: Accordingly, a consumer would not owe the credit intermediary any compensation for arranging a loan – i.e. no processing fee or similar. Furthermore, lenders may not charge consumers separately for part of the total costs incurred by the credit brokerage (Art. 5 and 34 para. 1).

What should consumers look out for?

Anyone who intends to apply for a loan in the near future should not ignore any brokerage fees. According to Swiss federal law, it is forbidden to charge customers for arranging a loan. The same also applies to processing fees. Nevertheless, there are a few banks that want to charge customers for account fees. You can trust our loan comparison, however, because we do not charge any fees when we determine the best offer for your personal loan free of charge.

Characteristics and criteria for reliability

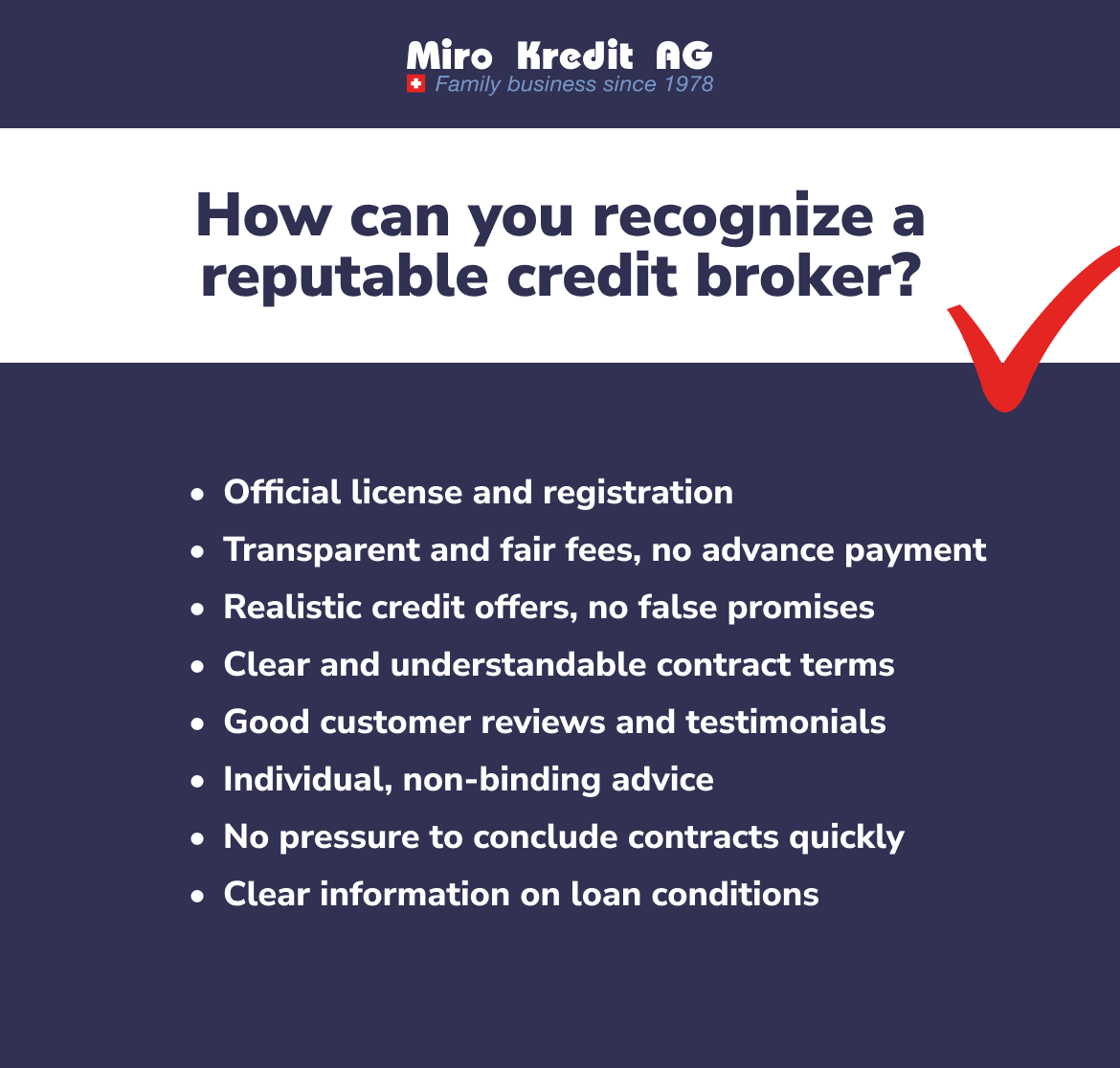

Regardless of whether you want to take out a new loan or pay off a loan, the reliability of a credit broker is of crucial importance for consumers looking for a suitable loan. There are a number of features and criteria that you can use to assess the reputability of credit partners:

- Licensing: A decisive feature of the seriousness of a credit broker is its licensing and regulation by the relevant authorities. A reputable broker always operates within the legal framework and meets certain standards, which are guaranteed by official approvals.

- Transparency: Reputable loan brokers are characterized by transparency and openness. They inform you clearly and comprehensibly about all costs incurred, without confusing fees or hidden costs. The Federal Consumer Credit Act even prohibits the charging of fees when brokering personal loans.

- Data protection: In an increasingly digital world, reputable credit brokers attach great importance to the protection of your personal data. They set the highest data protection standards to ensure the security of their customers.

- Experience: Reputable loan brokers also attach great importance to ensuring that contracts cover all aspects and are clearly understandable for you. They are always available to answer questions about the terms of the contract and clarify any ambiguities.

- Contract conditions: Seriöse Kreditvermittler legen zudem grossen Wert darauf, dass Verträge alle Aspekte abdecken und für Sie klar verständlich sind. Sie stehen jederzeit zur Verfügung, um Fragen zu den Vertragsbedingungen zu beantworten und Unklarheiten zu klären.

- Personal advice: Last but not least, personal advice is also a sign of a reputable credit broker. Reputable loan brokers take the time to understand your individual needs and financial situation and offer you tailor-made solutions instead of presenting standardized offers.

That’s why seriousness is important when brokering loans

The importance of reputability in credit brokerage cannot be overemphasized, as it has a direct impact on the financial security and well-being of consumers. A reputable credit broker not only offers you fair conditions and transparent information but also helps to strengthen your confidence in the financial market.

By working with a reputable intermediary, you can be sure that your financial interests are protected and that you are not taking any unexpected risks. In addition, the reputability of a credit intermediary supports the long-term relationship with customers, as it is based on trust and reliability. As a consumer, you can rely on a reputable credit intermediary to support you at every step of the credit process and provide expert help if you have any questions or problems.

Possible risks

Despite strict regulation and the efforts of reputable credit brokers to provide a trustworthy service, there are still some potential risks for consumers. For example, some rogue lenders take advantage of consumers’ financial emergencies and shortages to defraud them. For example, they demand advance payments before the loan has even been paid out. These advance payments are often demanded for opaque reasons and allegedly serve to shorten the processing time of the loan. If you suddenly come across invoices for so-called “express processing” from a credit broker, you can be sure that you are dealing with a dubious provider.

There is also a potential risk that your personal data could be misused. Rogue lenders may use your sensitive information for fraudulent purposes or resell it, which can lead to identity theft and other forms of financial harm.

It is therefore crucial that you pay attention to seriousness and trustworthiness when choosing a credit broker and, if in doubt, seek professional advice to minimize possible risks.

What exactly is a credit broker?

A credit broker such as Miro Kredit AG is a specialized service provider that acts as an intermediary between potential borrowers and credit institutions. While banks often negotiate directly with customers, intermediaries offer you the opportunity to choose from a wide range of offers from various credit partners and filter out the best loan offer for your needs.

Miro Kredit AG is characterized by its seriousness and commitment. The main advantage of working with an intermediary like Miro Kredit AG is the individuality and the wide range of offers. Thanks to our many years of experience and comprehensive market knowledge, we can often offer you better conditions or tailor-made offers that meet your individual needs. In addition, we at Miro Kredit AG act transparently and responsibly, which means that our customers can place a high degree of trust in us.

How are credit brokers paid?

Loan brokers can be remunerated in various ways, depending on the agreements with lenders and local market standards. A common method of remuneration for loan brokers is the commission or brokerage fee they receive from lenders. This commission is usually calculated as a percentage of the loan amount and paid to the broker after the loan agreement has been concluded.

Which bank is the best for a loan?

There is no one-size-fits-all answer to the question of the best bank for a loan, as this depends heavily on your individual needs and circumstances. Different banks may have different loan conditions and offers, which can vary depending on the loan amount, term, credit rating, and other factors. You should consider not only the interest rates but also other conditions such as repayment flexibility and customer service. Online comparison platforms can help you get an overview of the various offers and find the bank that best suits your financial needs.

To find the best bank for a loan, it is therefore advisable to compare various offers from different banks. As a loan comparison platform, Miro Kredit AG is the ideal choice when it comes to finding the loan you need. Whether you are looking for a new loan or a loan increase, you will always find the best loan offers at Miro Kredit AG.

Which loan is realistic?

Before you apply for a loan, however, it is important to consider how high the loan amount should be and whether you can afford it. Your financial situation and your individual creditworthiness are of decisive importance here. A realistic loan should always be in line with your financial possibilities without causing an excessive financial burden. As soon as you have informed yourself about the various options and have found a suitable combination of loan amount and term using our online loan calculator, you can submit an official loan application.

To apply for a loan, simply upload all the necessary documents. Your application will then be checked by our experts. If the loan matches your income and credit rating, it will be approved after a short processing time and you will receive your money in your account after the 14-day withdrawal period has expired.

Where can I always get a loan?

There is no guarantee that you will always get a loan everywhere. The granting of a loan depends largely on your creditworthiness, the desired loan amount, and your ability to repay. Although there are some providers who will grant loans even if you have a poor credit rating, this is a clear sign of a dubious credit broker. Reputable banks and credit brokers, on the other hand, take the information on your creditworthiness and credit capacity particularly seriously and thus ensure that you do not fall into debt and can easily meet the monthly charges. In this way, consumer protection is promoted and you as a borrower are protected from over-indebtedness.

What is the current interest rate for a loan?

The interest rates for a personal loan in Switzerland are based on the key interest rate of the Swiss National Bank (SNB). In addition, the loan amount, the term of the loan, and your credit rating also play an important role in calculating the interest rate.

At Miro Kredit AG, we always strive to offer you the best loans at the most favorable conditions. That’s why you’ll find loans with an effective interest rate between 4.5 and 11.95 percent and terms of 12 to 120 months. We can help you get an overview of the current interest rates and select the most favorable offer for you!

FAQ

Conclusion

In a market full of opportunities and potential pitfalls, choosing a reputable credit broker is crucial. Compliance with legal regulations, transparency in fees, data protection standards, a solid reputation, and personal advisory services are the hallmarks of reputable credit brokers such as Miro Kredit AG. Their role as a reliable link between borrowers and lenders facilitates access to financing options and helps you as a borrower to make informed decisions.

Make the loan comparison with Miro Kredit AG today to find the best personal loan that suits you and your plans!

Private loan calculation example:

Loan amount: CHF 10,000 without insurance. Repayment period: 12 months

Interest (including costs) amounts between CHF 240.50 and CHF 574.25. Effective interest rate 4.5% – 11.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)