Increase credit

Despite careful planning, the financial situation can change quickly. Unexpected expenses, major purchases, or changes in life circumstances can mean that the loan originally taken out is no longer sufficient. In such cases, a loan top-up offers an attractive solution.

By topping up an existing loan, you can obtain additional funds without having to apply for a completely new loan. This saves time and effort and allows you to react flexibly to new financial challenges. In this article, you will find out when it makes sense to top up your loan, the advantages and disadvantages of this option, and the conditions you need to meet.

Loan top-up – an interesting option

A loan increase means that the existing loan amount of a current loan is increased. This loan increase means that you, as the borrower, have more money at your disposal. This option is often used to cover unexpected expenses or to consolidate existing debts. For example, a loan for couples can also be easily increased.

An increase usually involves renegotiating the terms of the loan, which may involve adjusting the interest rate, term, and monthly repayments. Nevertheless, the process of increasing an existing loan is usually less complex than applying for a completely new loan.

As all relevant data is already available at the bank and the contact person is known, the bureaucratic effort is minimal. This allows the loan increase to be implemented quickly, which is particularly advantageous if a short-term increase in liquidity is required. After the increase, you as the borrower still only have one loan, which increases financial transparency.

When does a loan top-up make sense?

- Unforeseen expenses: Sudden medical expenses, necessary car repairs, or urgent renovations may require additional financial resources.

- Improving the living situation: The desire for a new kitchen, a modern bathroom or other home improvements can be realized by increasing the loan.

- Consolidation of debts: If there are several small loans or outstanding bills, it may make sense to consolidate them by increasing your credit. This allows you to maintain an overview and possibly benefit from better conditions.

- Investments: Be it in your own further training, a new business idea, or other projects – a loan increase can create the necessary financial basis.

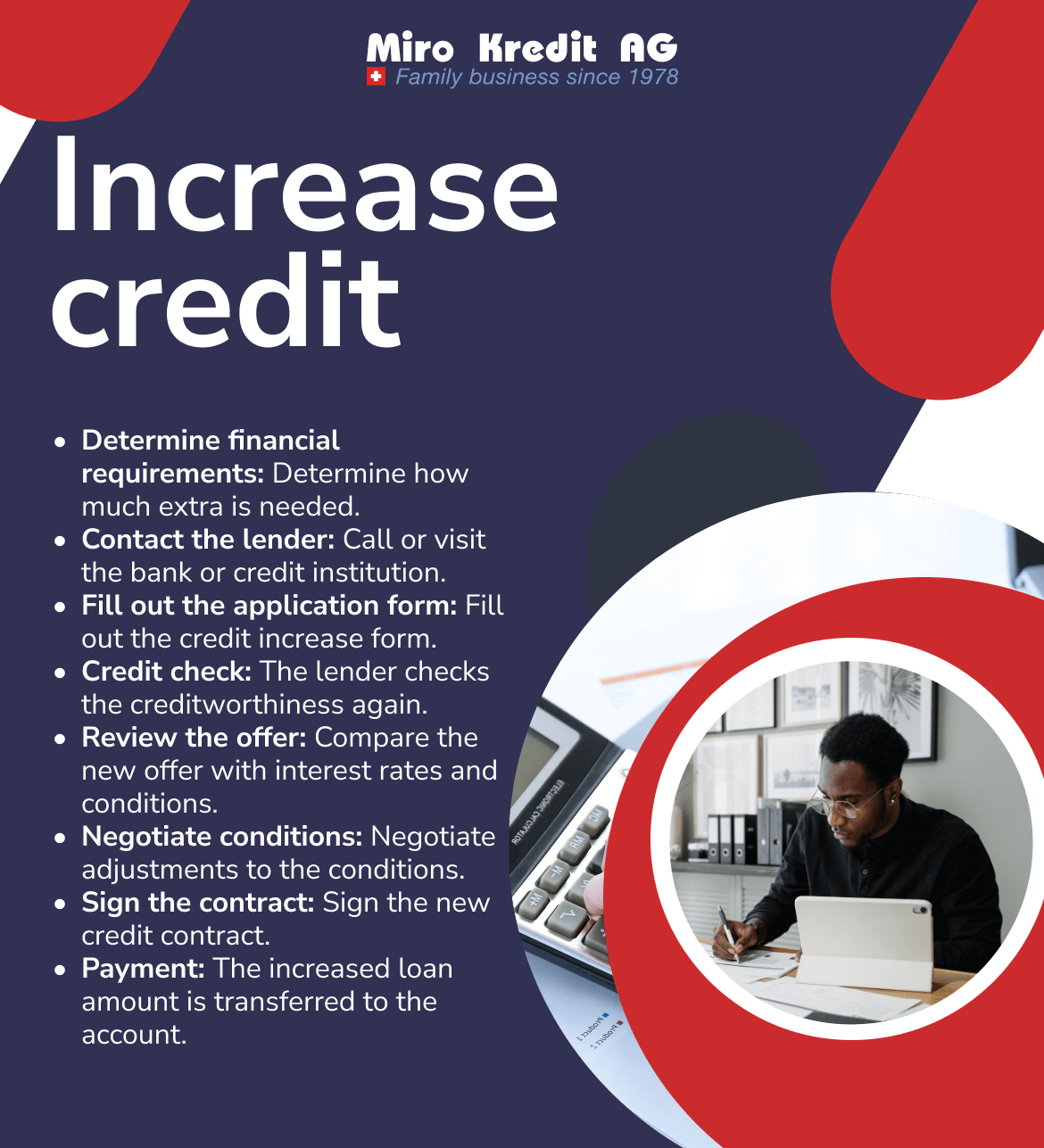

How does topping up the loan work?

If you would like to apply for a second loan or an increase to your existing loan, this basically goes through the same application process as the first loan. However, there are important differences: the existing loan is already taken into account as an ongoing expense in the budget. In addition, your payment history with your current lender will be checked, as this information is reported to the Central Office for Credit Information (ZEK) – both positive and negative feedback.

A record of regular and punctual repayments can therefore have a positive effect on credit conditions. In contrast, a record of late payments can have a negative impact on the chances of obtaining a new loan and its conditions.

If the review is positive, the lender will adjust the conditions and make you an offer. This will include the new loan amount, the contract term, and the interest rate. If you accept the offer, the existing loan agreement will be adjusted accordingly. This usually takes the form of a contract amendment or a new loan agreement that replaces the old one. Once the formalities have been completed, the increased amount is transferred to your account and can be used directly for the intended expenditure.

View of the audit and required documents

When checking for an increase in credit, your lender will carry out another credit check – this is stipulated in the Banking Ordinance. The check is necessary to ensure that you are able to meet the additional financial obligations.

You will usually need the following documents to apply for a loan:

- Valid identity documents to confirm your identity.

- Proof of your income, such as payslips or tax assessment notices.

- Information about existing liabilities, such as account statements or contracts from other loans.

- A self-declaration in which you explain your financial situation and possible collateral.

- The contract of your current loan in order to understand the existing conditions.

- Proof of existing collateral, if applicable.

These documents enable the lender to comprehensively assess your financial situation and make an informed decision about the loan increase. Depending on the lender and your individual situation, further documents may be required.

Advantages and disadvantages

Advantages:

- Quick availability: A credit top-up enables you to obtain additional funds quickly without having to go through the entire credit process again.

- Flexibility: You can react to changing financial needs and unexpected expenses without having to manage multiple loans.

- Better conditions: More favorable conditions and interest rates can often be negotiated by increasing the loan – especially if your financial situation has improved. You also have the option of declaring your loan in your tax return, which allows you to claim the interest costs against tax.

- Simplicity: Managing a single loan is easier and clearer than managing several smaller loans or credits.

Disadvantages:

- Increased monthly burden: Increasing the loan increases the monthly installments, which can lead to a higher financial burden.

- Longer term: An increase can extend the term of the loan, which means that you are tied to repayment for longer.

- Strict check: Depending on your financial situation, the new credit check may lead to a rejection or less favorable conditions.

- Risk of over-indebtedness: If the additional funds are not used sensibly, there is a risk that the debt burden will become unmanageable and lead to financial difficulties.

What conditions must be met for a loan increase?

In order to successfully apply for a loan top-up, certain conditions must be met. These conditions serve as security for the lender that you are able to meet the increased financial obligations. The most important requirements include:

- Good credit rating: Your creditworthiness must be sufficient to minimize the risk for the lender. This is determined by a new credit check.

- Stable income: A regular and sufficient income is crucial in order to be able to service the additional monthly installments.

- Low debt ratio: Your total debt should be in a reasonable proportion to your income. A high level of debt can lead to your application being rejected.

- Current credit status: The previous loan should have been serviced properly, without payment defaults or delays. A good payment history increases the chances of a top-up.

Some alternatives to increasing the loan

If a loan top-up is not the best option for your financial situation or is not approved, there are alternative solutions that can be considered.

Debt restructuring

An attractive alternative option to increasing the loan is debt restructuring – also known as debt consolidation or debt restructuring. This involves combining all existing liabilities and loans into a single loan.

The four-week notice period for consumer loans allows you to replace your current loan with a new and possibly higher loan. This is particularly advisable if you have other debts to pay off in addition to your current loan, such as an overdraft facility.

Additional credit

Another option is to apply for an additional loan from another credit institution. However, it should be noted that this can have a negative impact on your credit rating. Taking out two loans from different lenders within a short period of time signals a potentially unstable financial situation. This can affect your creditworthiness and potentially downgrade your score.

Further possibilities

Last but not least, there are various alternatives to the classic bank loan that you can consider if you urgently need money. These include the following:

- Personal loan: A personal loan from friends or family can be a quick and unbureaucratic loan solution. However, you should make clear agreements here to avoid potential conflicts.

- Overdraft facility: You can bridge short-term financial bottlenecks with an overdraft facility on your current account. However, this option should only be used for short periods of time due to the high interest rates.

- Selling assets: If possible, you can also sell unused assets such as a car, electronics, or other valuables to raise the funds you need.

FAQ

Conclusion

A credit top-up offers a practical solution for overcoming financial bottlenecks or making larger purchases without having to apply for a new loan. Miro Kredit AG will be happy to support you in the planning and implementation of a credit top-up and provide you with expert advice. Contact us to discuss your options and find the best solution for your financial situation.

Private loan calculation example:

Loan amount: CHF 10,000 without insurance. Repayment period: 12 months

Interest (including costs) amounts between CHF 240.50 and CHF 574.25. Effective interest rate 4.5% – 11.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)