Reduce loan installment

There can be many reasons for taking out a loan. Whether it’s to finance a car, renovate your own four walls, or consolidate existing debts – a loan can offer a sensible financial solution in many situations. However, regardless of the reason for taking out a loan, it is always important to keep an eye on the financial implications and take measures to reduce borrowing costs if necessary.

For many people, the monthly loan installment is a fixed amount in their budget that often eats up a considerable part of their income. But what happens when the financial situation changes and the loan installment becomes a burden? Is it even possible to reduce the loan installments? And what is the best way to create financial leeway? In this article, you will find out what options you have to reduce the monthly installments on your loan.

Is it even possible to reduce loan installments?

Alongside the loan amount, the monthly loan installment is probably the most important key figure in the loan agreement. When you take out the loan, you will find out how high the monthly installment will be so that you can estimate whether the monthly installment is affordable over the entire term of the loan.

As a general rule, the longer the loan term, the higher the loan costs, as more interest is incurred. However, the monthly installments increase with shorter terms, although the total cost of the loan decreases. It can therefore make sense to extend the term in order to reduce the monthly burden. However, the question arises as to whether this is even possible.

Can you negotiate with banks?

The interest rates on loans are generally fixed and therefore non-negotiable. The individual interest rate is therefore largely dependent on the borrower’s creditworthiness and the bank’s general lending conditions.

While you can choose other conditions such as the loan term yourself, the interest rates depend largely on the current interest rate level and your individual financial situation. You should therefore choose a loan that suits you and your financial situation from the outset. We at Miro Kredit AG offer you a loan comparison that will always help you find the best loan for your needs.

What should the maximum loan installment be?

According to the Consumer Credit Act (KKG), consumer credit may not exceed CHF 80,000 – otherwise, it is no longer a personal loan. In addition, consumer loans must generally be repaid within 3 to 36 months.

In contrast, there is no general answer to the question of the maximum amount of a loan installment, as this depends heavily on the individual financial circumstances of the borrower. However, as a rule of thumb, the monthly loan installment should not exceed 30 to 40 percent of your net disposable income. This will leave you enough leeway for other expenses such as everyday living costs and unforeseen events.

What happens if you can’t pay a loan installment?

If you are unable to pay a loan installment on time or at all, you will automatically be in default on the following day without a prior reminder. This means that a reminder can now be sent for the installment due and interest will be charged on the arrears. In addition, lenders have the right to withdraw from the loan agreement if you fail to meet your payment obligations as a borrower.

However, it can also happen that you are no longer able to pay the loan costs due to unemployment. In such cases, residual debt insurance can be useful. This ensures that your loan installments continue to be paid in the event of involuntary unemployment.

In principle, it is important to act quickly and talk to the bank. In many cases, the bank is prepared to offer a temporary deferral in the form of an installment break or another solution to reduce the financial burden.

What is the best way to pay off a loan?

Do you already have a loan and want to pay it off as efficiently as possible? Then there are a few ways in which you can pay the monthly installment without any problems.

On the one hand, you have the option of repaying your loan early or making regular unscheduled repayments. In this way, you reduce the total cost of the loan and shorten the term. However, you should bear in mind that this will also increase your overall burden. If you choose a loan with the longest possible term instead, you can ensure that the monthly burden is particularly low, allowing you to pay the installments easily.

On the other hand, you can also restructure your debt to pay off an existing loan. By taking out a new loan, you can pay off the old loan and pay off the new loan in monthly installments instead.

Can I change the monthly loan installment during the term?

In most cases, it is possible to change the monthly loan installment during the term of the loan. For example, you can increase the loan amount of your existing loan by concluding a new loan agreement to replace the old one.

However, if you would like to reduce the loan amount, you can do so by making unscheduled repayments to pay off the loan early and without incurring any costs. However, you should bear in mind that it often makes more economic sense to pay off the loan in monthly installments, as the total monthly burden is significantly lower this way. In principle, you must adhere to the agreed installments for the entire term of the loan.

Does it make sense to repay a loan early?

Although early repayment of a loan offers some advantages, it is not necessarily always the best option. You can save on interest costs by paying off your loan early, either by adjusting your existing loan agreement or by switching to a bank with lower interest rates and rescheduling.

However, before making an early repayment, you should check whether this is actually the most economical decision. Sometimes the costs of early repayment or the new conditions of a debt rescheduling can outweigh the potential interest savings. It is therefore advisable to compare the interest rates at different banks and possibly also carry out a loan comparison in order to obtain the best conditions. As a loan comparison platform, Miro Kredit AG always offers you the most favorable loans at the best conditions. This allows you to pay off your existing loan as part of a debt restructuring and reduce the monthly loan installment if necessary.

What happens if you pay off a loan earlier?

Repaying your current personal loan early can have undesirable consequences. Although the Consumer Credit Act (KKG) regulates early repayment, certain costs may still be incurred. Although you are entitled to a waiver of the loan interest for the unused period and a reasonable reduction in the remaining costs, you may be subject to early repayment fees.

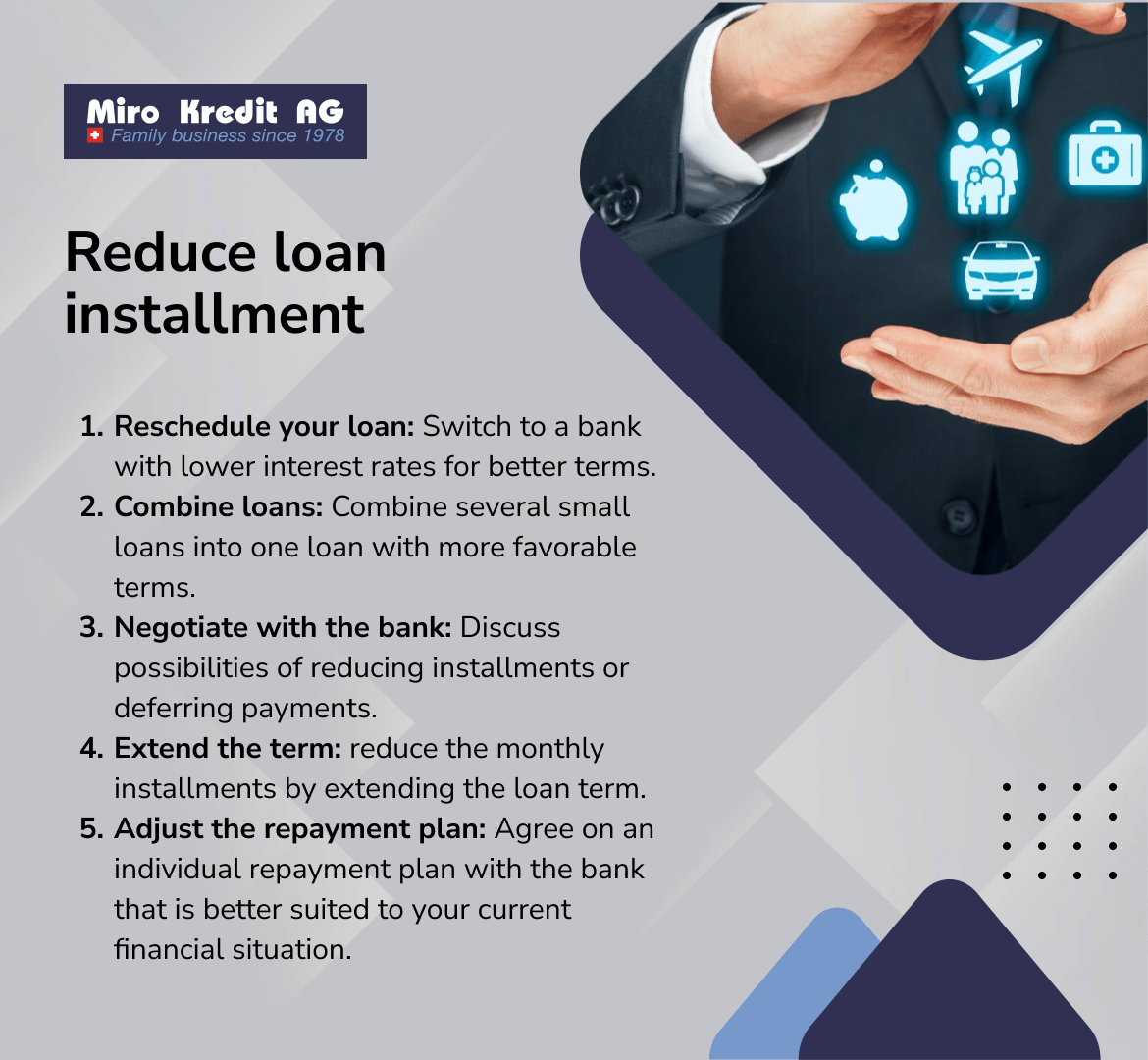

Our tips for a lower loan installment

Loans can be a burden on your monthly budget and can restrict your financial freedom. A lower loan installment and a longer term can help. We give you tips on how you can lower your loan installment and soon have more money at your disposal again.

1. Extension of the credit periods

The simplest method you can use to reduce the monthly loan installment is to extend the term. You retain full flexibility, as you can always repay a loan earlier, but not later. The loan amount is spread over more installments, allowing you a higher monthly budget. This reduces the risk of payment difficulties by improving your liquidity.

2. Redeem or consolidate loans

This option is particularly useful when interest rates are falling. In the case of longer-term contracts, falling interest rates can quickly make it worthwhile to replace the current loan with a new personal loan or online loan. In addition, interest rates have also been lowered by the legislature. In 2016, for example, the maximum interest rate for loans in Switzerland was reduced from 15% to 10%.

This method is a good choice if you have several loan agreements that can be consolidated into a single one. This loan consolidation gives you a better overview of your finances and therefore better planning of your monthly budget while saving on interest at the same time.

With a loan in Switzerland, the interest rate always depends on the creditworthiness of the borrower. If your credit rating has improved over time, it is quite possible that you will now receive a better offer. A new loan application can therefore also be worthwhile if the loan was taken out when interest rates were lower, but your own income situation has improved significantly. Replacing credit cards with a normal personal loan or online loan is particularly worthwhile here.

3. Compare credit offers

The number of loan offers is difficult to keep track of. Numerous banks come up with different interest rates, terms, and amounts for online loans. Comparing them individually would be a Sisyphean task, as new offers are added every day and others are taken off the market or modified.

Furthermore, all of these offers are non-binding, as your personal creditworthiness also influences the conditions. If you want to apply for a loan from many different banks, you also risk a poor credit score, as frequent applications and rejections are also registered with the ZEK.

In such a situation, it is extremely helpful to be able to rely on professional help. Miro Kredit AG has been offering its credit brokerage services for many years and always endeavors to find the right loan in Switzerland for every customer.

Customers have access to an easy-to-use loan calculator, which they can use to search for a personal loan or online loan themselves. All you need to do is enter the desired loan amount and term in the form. The installment amount, total amount, and interest are then displayed automatically.

4. Credit for homeowners

If you already own a house or apartment, you will benefit from a better credit rating. Interest rates of less than 5% are quite possible here and the loan installments are correspondingly lower as the loan amount is reduced. If you want to apply for a personal loan as a property owner, you do not have to make an entry in the land register or pay fees for a mortgage agreement. This makes the personal loan a favorable loan in Switzerland, especially for small and medium-sized investments, where low loan rates are possible.

5. Credit Insurance

Voluntary credit insurance offers both the bank and you as the borrower additional protection against unplanned loan defaults. Be it due to job loss, sudden illness, or disability – the credit insurance will step in in such a case and take over the installment payments for you. As a result, your credit rating is not affected and you have a better chance of obtaining favorable loan rates if you apply for a loan again.

FAQ

Conclusion

Thanks to our Miro Kredit experience, we are always at your side when it comes to questions about personal loans. In this context, the loan rate is probably the most important issue for borrowers. By planning carefully and using the right strategies, you can reduce your monthly charges, improve your credit rating, and benefit from more favorable credit conditions in the long term.

Private loan calculation example:

Loan amount: CHF 10,000 without insurance. Repayment period: 12 months

Interest (including costs) amounts between CHF 240.50 and CHF 574.25. Effective interest rate 4.5% – 11.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)