Education loan Switzerland

Education during compulsory schooling is free of charge in Switzerland. However, the person in education or their parents are generally responsible for financing their subsequent attendance at universities or other education and training institutions.

While education or further education can be very expensive, it is often worth the cost. The average Swiss student spends around CHF 25,000 per year on their education – in some cases even more for international students, who have to pay higher prices than domestic students due to lack of access to universities in their home country. On top of this, there are other expenses such as admission fees or materials needed during their studies, which add up over time along with the cost of living.

So when it comes to getting a good education, the expenses can quickly add up. Tuition fees, study materials, accommodation, food – the list goes on and on. In this case, an education loan can be a great help. But what financing options are there for Swiss trainees and students and how can an education loan help students?

Switzerland as an attractive country for employees

Switzerland is not only considered a beautiful country with breathtaking nature but also an extremely attractive labor market for skilled workers from all over the world. For the sixth time in a row, Switzerland has been named the world’s most attractive country for highly qualified workers by the IMD Business School. No wonder, because thanks to its strong economy and a large number of renowned educational institutions, Switzerland attracts a large number of students and trainees every year.

Various options for financing training

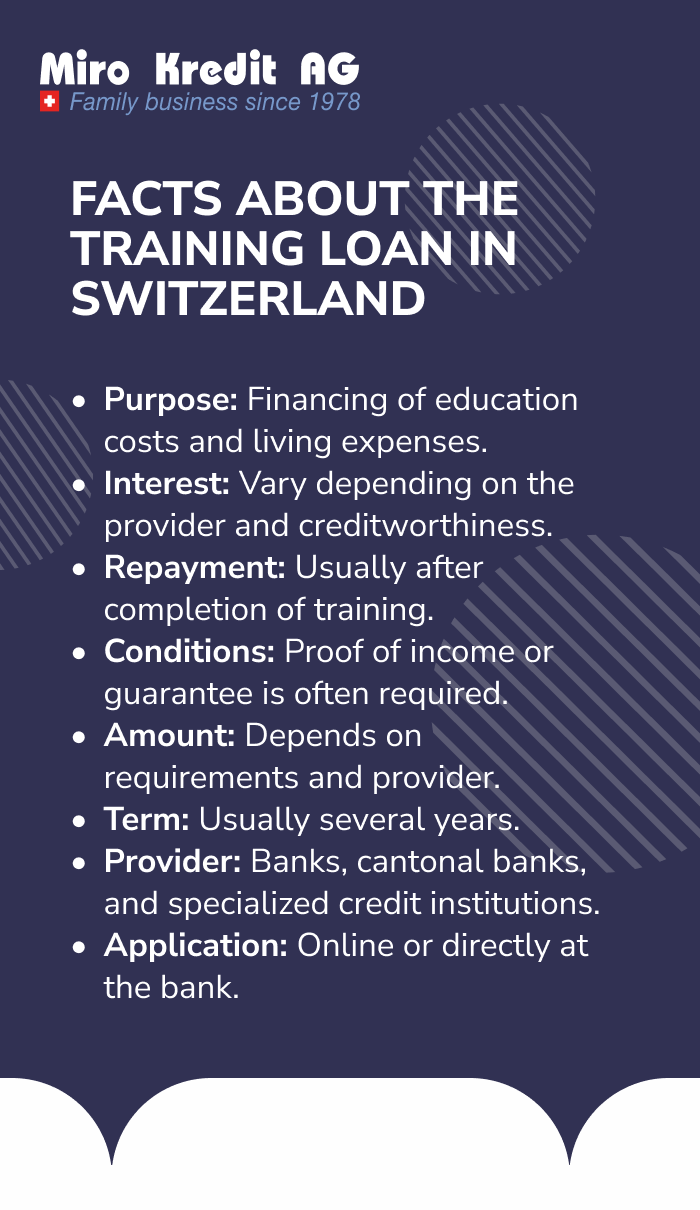

Similar to leasing or loans, there are also various financing options for educational projects. An educational loan may be the right solution, especially for students who do not have sufficient financial resources. However, in addition to a traditional student loan, there are also other options for financing training or further education and making your educational dreams come true.

Financing of education by the parents

Many students in Switzerland receive financial support from their parents to finance their education. Parents can either bear the entire cost of education or cover part of the costs in order to give their children access to a high-quality education. Some parents save for their children’s education or studies from birth, while others have a high enough income to support their children financially.

However, if these options are not enough, there are still loans available. A personal loan is not specifically related to school costs and instead works more like any other type of borrowing – the borrower (in this case the parents) is subject to a credit check which determines the terms.

Student credit and student loans

For students who do not receive sufficient financial support from their parents or who need additional funds to finance their education, educational loans or student loans are available. Swiss law requires that borrowing must not result in over-indebtedness.

A key criterion here is the monthly disposable income, which is usually low for students. This is why training and student loans are rarely offered by banks. However, there are also banks that have specialized in this niche market. For example, you can find suitable student loans at Miro Kredit AG.

An alternative would be so-called peer-to-peer loans. These come from private individuals, whereby students can specify the desired loan amount, term, and the interest rate they are willing to pay. If enough investors are found, the loan is paid out. As a rule, only the interest is paid during the course of study, with repayment of the capital usually only beginning after graduation. This keeps the financial burden low during the course of study.

Another option is student loans from the cantons. As not all students qualify for a scholarship, the cantonal scholarship authorities offer interest-free loans that must be repaid after graduation. However, these cantonal student loans can only be used to finance initial education and – unlike a private loan – cannot be used for further education programs.

Scholarship

In addition to loans, scholarships are also a way of financing education. In Switzerland, the cantons are responsible for awarding scholarships. Eligibility for cantonal funding is based on the family and financial circumstances of the students and their families. In addition, only students who are resident in the respective canton under scholarship law, come from a low-income family, and are completing a recognized course of study are generally entitled to a scholarship.

Information on the requirements for applying for a scholarship can be found on the official websites of the respective cantons. For example, the Office for Youth and Career Guidance of the Canton of Zurich offers comprehensive information on the requirements and calculation factors. A scholarship calculator makes it possible to determine the chances of receiving a scholarship in advance. University websites also offer information on financial support options during your studies.

Loans for further training

In addition to financing undergraduate courses, banks and financial institutions in Switzerland also offer loans for continuing education programs and vocational training. These loans enable professionals to expand their knowledge and skills and develop their careers. Crowdlending platforms also offer such loans by connecting students or professionals with private investors.

Private foundations and funds

There are also various private foundations and funds in Switzerland that offer financial support for educational purposes. These organizations support both Swiss students and international students in financing their education and help to create educational opportunities for all.

The allocation of financial resources by private foundations and funds usually depends on various criteria, such as place of residence or regular income. In addition, a combination of a cantonal scholarship and funding from a foundation or fund is often conceivable, although the scholarship awarding authority must be informed in this case.

Student Employment

Many students in Switzerland finance their education through student employment. Alongside their studies, they work part-time jobs or internships to supplement their income and cover their education costs. Almost half of students work one to two days a week in a part-time job. This experience not only enables students to be financially independent but also to gain practical work experience.

However, the Bologna system with its tight schedules often makes it difficult to pursue a part-time job, so alternative financing methods such as an educational loan or training credit are becoming increasingly attractive for students.

Some scholarships for education in Switzerland

Under certain conditions, students in Switzerland can also receive state scholarships. Foundations and funds also offer financial support for people in education. The advantage here is that not only Swiss citizens can benefit from these cantonal scholarships, but also refugees and foreign nationals resident in Switzerland. Swiss nationals living abroad may also be eligible for state scholarships under certain conditions.

Scholarship from the canton

The cantons in Switzerland offer their residents scholarships to finance their education. These scholarships can be applied for at the cantonal scholarship office. The requirements for receiving such a scholarship include, among other things, that both the student and their parents only have a low income and few assets. The exact conditions vary from canton to canton. Some cantons even offer financial support for a second degree or further education.

In principle, scholarships can be awarded once or repeatedly and generally do not have to be repaid. However, some cantons require repayment if the student’s financial situation improves significantly at a later date. Educational loans, on the other hand, must always be repaid – regardless of the financial situation. Interest is also often charged on these student loans.

Scholarships from foundations and funds

In addition to state scholarships, there are a large number of private foundations and funds in Switzerland that offer scholarships for students. These foundations can be set up by the federal government, municipalities, and universities as well as non-profit organizations or even wealthy individuals, and aim to provide financial support to talented students.

The application requirements and selection criteria for these scholarships vary depending on the foundation, so it is advisable to find out about the various options at an early stage and apply in good time. The relevant addresses of such foundations and private funds can be obtained from the cantonal scholarship offices. The federal government also maintains a list of foundations that provide study grants.

Federal Excellence Scholarship

The Swiss Government Excellence Scholarship is a prestigious scholarship program awarded by the Swiss Confederation. It is aimed at highly qualified foreign students with outstanding academic achievements and exceptional talent in their field of study. Scholarship recipients are selected on a competitive basis and funding is provided by the government.

This scholarship offers not only financial support but also the opportunity to take part in exclusive events and networking meetings to promote the personal and professional development of scholarship holders. Interested students should contact the State Secretariat for Education, Research, and Innovation for information on the application requirements and the application process.

How do I get a Swiss education loan?

Education loans offer a great way to finance your education. For example, education loans can help you pay for a variety of school-related expenses such as tuition fees, room and board, textbooks, and more. This means you don’t have to miss out on a quality education for financial reasons.

However, before you decide on a loan, it is important to compare the interest rates and conditions of different lenders. A careful comparison will enable you to find the best loan to suit your needs and financial means. By applying for a loan via platforms such as Miro Kredit AG, you can easily compare offers from different lenders and find the right education loan for your educational project.

Check authorization

Before applying for an education loan, it is first important to verify your eligibility for the particular loan program. Requirements may vary depending on the lender, but in general, you must meet the following criteria:

- Age of majority: To obtain a loan, you must be at least 18 years old and therefore have full legal capacity.

- Citizenship or residence in Switzerland: Most lenders require that you are either a Swiss citizen or have your usual place of residence in Switzerland.

- Admission to a recognized educational institution: You must often be enrolled at a recognized college, university, vocational school, or other educational institution in Switzerland and be able to provide proof of this.

- Credit rating: As with other personal loans, most lenders will check your credit rating to ensure that you are able to repay the education loan. This may involve checking your income, existing debts, and credit history. If you already have other payment obligations, you should know how long a ZEK entry will remain. This may have an influence on whether you can take out another loan.

- Degree program and degree progress: Some lenders may have specific requirements regarding the degree program or degree progress. For example, they may require you to be in a certain year of study or working towards a certain degree.

Once you have checked your eligibility, you can start the actual application process. The earlier you find out about the various loan options, the better your chances of getting an education loan that suits your needs. It is therefore worthwhile starting early with a loan comparison at Miro Kredit AG.

FAQ

Conclusion

Financing your studies can be a daunting task, but there are many different ways to do it. Switzerland, for example, offers a variety of education funding options – from government grants and private loans to student work and foundation scholarships.

Educational loans are a particularly attractive option for financing education. However, it makes sense to find out about the available options at an early stage and develop individual financing strategies in order to create a solid foundation for a successful education.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.45 and CHF 574.30. Effective interest rate 4.5% – 10.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)