ZEK entry: how long?

If you are planning to take out a new loan, you should be familiar with the Central Office for Credit Information (ZEK). It is often decisive in the question of whether or not you receive a loan. After all, all credit transactions are registered by the ZEK and viewed by lenders as part of the credit check. But how long do ZEK entries remain and what does such an entry actually mean? We clarify all these unanswered questions in this article.

ZEK: What is behind the abbreviation?

Regardless of whether you want to take out a lease or a loan – the entries in the ZEK are decisive for the approval of your loan. The Central Office for Credit Information is an independent Swiss creditworthiness database that collects and manages information on all of a person’s credit transactions – regardless of whether they are positive or negative.

The ZEK therefore acts as a kind of credit protection and control body and helps to minimize the risk of credit defaults. However, it not only stores information on personal loans but also on leasing contracts, credit cards, and other financial obligations.

A look at the ZEK entry

Many people get nervous when they hear the term “ZEK entry”. However, such an entry is basically something completely normal. In fact, practically every adult Swiss citizen has a ZEK entry, provided they have at least one credit card.

A ZEK entry is simply a record of your financial obligations. EIt contains information such as outstanding loan amounts, payment history, loan terms, and other relevant data. Each time you take out a loan or enter into a financial obligation, a corresponding entry is made in your ZEK file.

Most Swiss banks and lenders check your ZEK entries before granting you a loan. A negative entry can therefore have a negative impact on your creditworthiness and result in you being offered loans on less favorable terms or even being rejected.

What information does the ZEK store?

The ZEK stores a wide range of information about your financial situation. This includes:

- Credit information: Information about current loans, including loan amount, remaining debt, term, and payment history.

- Leasing contracts: Data on leasing contracts for cars, furniture, and other items.

- Credit cards: Information about credit cards, including the credit limit and outstanding amounts.

- Arrears and delays: The ZEK also records payment arrears and delays in the settlement of obligations.

- Debt counseling and debt collection: Information on debt counseling and debt collection is also part of the ZEK entry.

ZEK codes under the magnifying glass

The ZEK uses specific creditworthiness codes to identify different types of information in your entries. These codes are critical to interpreting your financial situation and can affect how lenders evaluate your creditworthiness. The most common ZEK codes that are important to lenders are as follows:

- 03 – Slow payment / often with reminders: Code 03 indicates that the borrower is having difficulty paying their debts on time. This can be caused by delayed or irregular repayment of loans, leasing installments, or credit card debts. The presence of this code signals to lenders that the borrower may have payment problems and there is an increased likelihood of loan defaults.

- 04 – Special measures and late payments: An entry with the code 04 indicates special measures and late payments. This may mean that the borrower has already received reminders or that the lender has had to take special measures to collect payments. As a rule, the presence of this code leads directly to the rejection of follow-up applications for loans. However, there may also be exceptions if a certain amount of time has passed since the entry and the borrower can prove a stable financial situation.

- 05 – Partial/total loss: Code 05 indicates a partial or total loss where the lender may have suffered significant financial losses. This may be the case if the borrower is insolvent or can no longer service the debt. The presence of this code usually leads directly to the rejection of follow-up contracts for loans.

ZEK and loans

If you would like to apply for a personal loan such as an education loan, the ZEK plays a decisive role in the granting of such a loan. Lenders use the information in the CRC to assess the risk of a loan default and evaluate the creditworthiness of a potential borrower.

A clean ZEK entry, with no negative entries such as payment arrears, can help lenders see you as a trustworthy customer. On the other hand, negative entries can reduce your chances of being approved for a loan or lead to higher interest rates.

It is therefore important to always keep an eye on your financial obligations and ensure that your ZEK entries are correct and up to date. You have the right to self-disclosure in order to view the information stored about you. This can be useful if you intend to apply for a loan.

ZEK database – What is it?

The ZEK database is the heart of the system for recording and managing credit information in Switzerland. It serves as a central data repository for all information on credit transactions, leasing contracts, and financial obligations of consumers. The database enables lenders and banks to access relevant information quickly and easily in order to make informed decisions about granting loans.

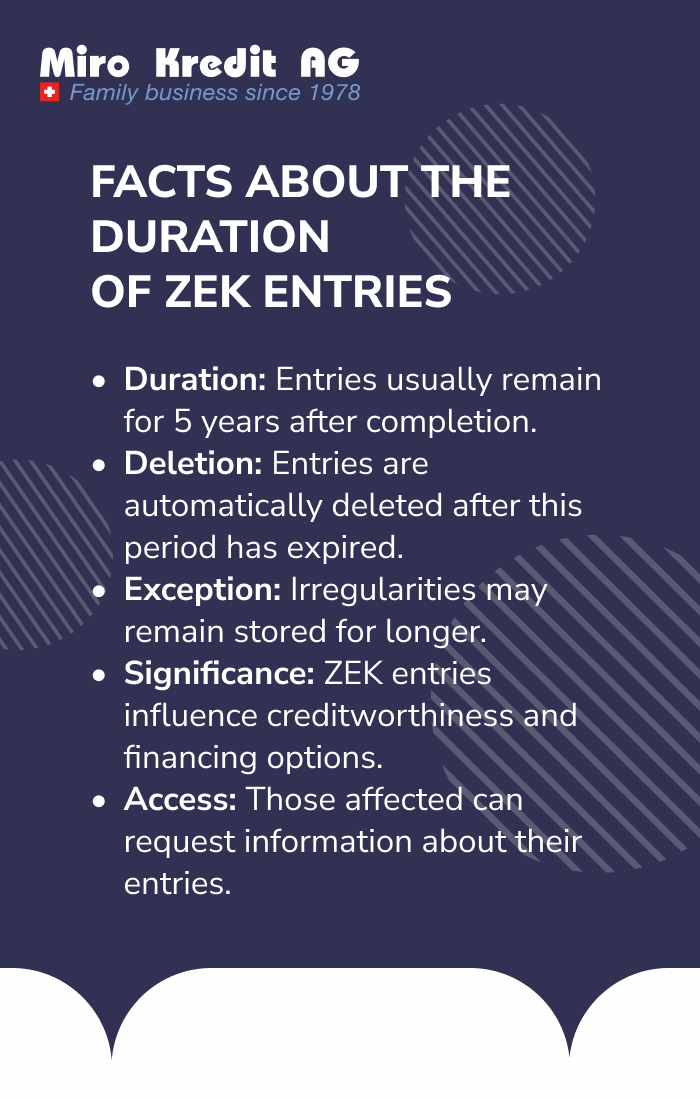

According to the Data Protection Act, however, the entries may only be stored for as long as the principle of proportionality allows. The data stored in the ZEK database is therefore subject to defined retention periods, which can be viewed in the ZEK’s regulations. Open credit applications, for example, are stored for a period of three months, while a reference to patronage is stored for a maximum of 30 years. Problems with contractual partners are stored for a period of five years. In some cases, you as a consumer even have the right to request deletion, for example, if an entry is incorrect or particularly outdated.

FAQ

Conclusion

The ZEK database contains detailed information on borrowers, including their identity, credit history, outstanding loans, and payment history. By having access to this data, lenders can better assess the risk of loan defaults and make lending decisions that are beneficial to both them and the borrowers. ZEK entries therefore play a key role in ensuring financial stability and the proper granting of loans in Switzerland.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.45 and CHF 574.30. Effective interest rate 4.5% – 10.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)