Credit rating

Do you need a cash injection and would therefore like to take out a loan? Miro Kredit AG offers you numerous credit options – from classic personal loans to renovation loans.

However, your creditworthiness and credit standing – also known as credit rating – are basic prerequisites for successful lending. Both are carefully checked as part of a credit check to ensure that you are not overstretching yourself by taking out a loan and that you can repay the loan with peace of mind. But what information exactly is scrutinized during a credit check and how can you improve your creditworthiness? Find out in this article.

What is checked when I apply for a loan?

Regardless of whether you are applying for an installment loan, a car loan, or a renovation loan – every time you apply for a loan, you go through a credit check. This credit check forms the basis for the approval of every consumer loan in Switzerland and is therefore decisive. It determines whether you as a borrower receive a consumer loan and if so, on what terms. The loan amount, term, and interest rate are only determined after your data and solvency have been analyzed.

The credit check consists of two main components: the creditworthiness check and the credit assessment. This check is intended to ensure that the financial burden is acceptable for you as a borrower and also to minimize the risk for the financial institution or credit institution.

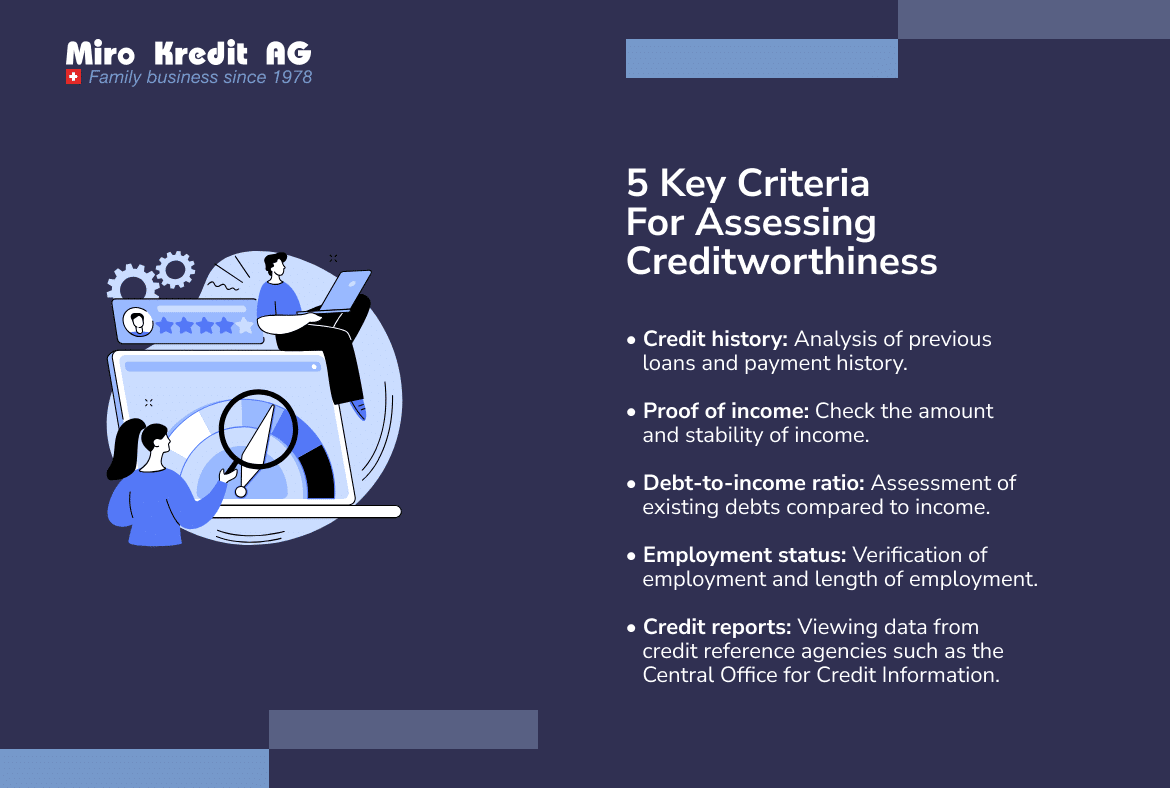

Reviewing a loan application is a thorough process designed to ensure that the financial burden is acceptable to the applicant and the credit risk is minimized for the lender. Several factors play a role here:

Creditworthiness

Creditworthiness refers to the basic suitability of an applicant to take out a loan. The creditworthiness check in accordance with the Consumer Credit Act (KKG) is intended to ensure that the granting of credit does not lead to over-indebtedness on your part. In particular, it is checked whether you are at all eligible as a borrower and can conclude legally binding credit agreements, as you have already reached the age of majority.

We will also check whether your financial situation allows you to repay the loan on time. To determine this, a detailed review of your monthly income is carried out after deducting all fixed costs and expenses. In the case of consumer loans, a standardized budget calculation is usually carried out to determine a maximum loan amount. This budget calculation usually takes into account the following expenses:

- Your housing costs

- Taxes payable and health insurance costs

- Existing payment obligations

- Your non-attachable part of the income

- Alimony or maintenance payments to be paid

- Costs of your commute

All these expenses and fixed costs are compared to your monthly income from any source to determine your budget.

Your creditworthiness is therefore linked to legally defined minimum requirements that you must fulfill as a borrower. In addition to being of legal age, you must also be able to repay the loan, including interest, within 36 months. Although you must meet this requirement, you can of course agree a longer term with the credit institution.

Credit rating

In addition to your creditworthiness, your credit standing (credit rating) is also a decisive prerequisite for a successful loan application. The creditworthiness check goes one step further and also includes your personal trustworthiness. In particular, your payment history and willingness to pay are assessed.

The creditworthiness check therefore determines how likely it is that you will pay the loan amount and all costs incurred, including interest and fees, on time. However, this assessment is not only based on your willingness to pay but also takes into account other factors such as your residence status and length of stay in Switzerland, your age, your nationality, and the number of times you have moved.

Lenders use various sources of information and methods to check your payment history. While creditworthiness databases from external providers, such as the Central Office for Credit Information (ZEK), serve as an important source, business information can also come from other credit agencies such as Intrum Justitia AG, crif AG, or Creditreform. Finally, the collected data can be used to carry out an analysis that shows the correlations between your personal information and historical credit experience and provides the lender with an overview of your creditworthiness.

What is the ZEK and what does it do?

The ZEK (Central Office for Credit Information) is a comprehensive Swiss creditworthiness database that plays an important role in checking your creditworthiness. All positive and negative reports of your credit history are collected and stored here. In this way, credit institutions can get a comprehensive picture of which financial obligations you already meet and which you may not.

Your payment history is particularly important when granting credit, as lenders are not allowed to grant consumer loans if they would lead to over-indebtedness. The credit check therefore not only serves to protect lenders but also ensures that you do not overstretch yourself financially..

In some cases, however, there may also be incorrect ZEK entries. In this case, it may make sense to have the incorrect ZEK entry deleted, as this may jeopardize your borrowing. After all, you will only get the best conditions for your loan if your credit rating is good. The ZEK enables a precise assessment of your creditworthiness and therefore helps you to make responsible credit decisions.

How can creditworthiness be improved?

Creditworthiness is the be-all and end-all when granting a loan. If the credit check reveals that you have a low credit rating, you may not be granted a loan at all. However, this does not have to be set in stone, as you certainly have the opportunity to improve your credit rating.

An excellent credit rating can not only increase the likelihood that you will get a loan at all, but may also get you better conditions. You have the following options to strengthen your credit rating:

- Punctual payments: Paying bills and loan installments on time is crucial. Try to avoid late payments as this will have a positive impact on your payment history.

- Reduce debts: Reduce existing debt by making regular payments. A lower debt-to-equity ratio improves your financial situation and signals to lenders your ability to repay.

- Correct discrepancies: Regularly check your credit reports for possible errors or discrepancies. If you discover any irregularities, you should have them corrected.

- Long-term financial planning: Show that you have your expenses under control with solid financial planning. This can have a positive effect on the assessment of your creditworthiness.

- Do not apply for excessive credit: Avoid making unnecessary credit applications. Every credit application leaves a mark on your credit history. Several applications in quick succession can be interpreted as financial insecurity.

What to do if you are not creditworthy?

If the result of your credit check is negative, your loan application will not be approved. These rejected credit applications are registered in the Central Office for Credit Information (ZEK) and remain accessible there for two years. As this can have a negative impact on the credit check when you reapply for credit, it is generally advisable to avoid applications where there is little chance of success.

In order to better assess your own financial situation, you should therefore carry out an independent budget check before applying for a loan. In this way, you can identify financial problems at an early stage and significantly improve your chances of a successful credit check.

FAQs

Conclusion

A borrower’s creditworthiness is a decisive factor in the approval of a loan. All lenders carry out a credit check before granting a loan to ensure that you can meet this obligation. In addition, you can strengthen your credit rating to have more success with future loan applications and finally realize your plans.

Private loan calculation example:

Loan amount: CHF 10,000 without insurance. Repayment period: 12 months

Interest (including costs) amounts between CHF 240.50 and CHF 574.25. Effective interest rate 4.5% – 11.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)