Replacing credit cards: how it works

Repaying credit cards can be a good way to reduce high interest rates and bring your finances back into balance. Especially in Switzerland, where credit cards are often burdened with high interest rates, debt restructuring or repayment can make sense.

If the monthly installments become a burden or you lose track of several cards, targeted debt restructuring can help you pay off debts more efficiently. In this article, you will find out why it makes sense to pay off a credit card, what options are available to you and how you can best approach the entire process to regain financial freedom.

Why it makes sense to restructure your credit card

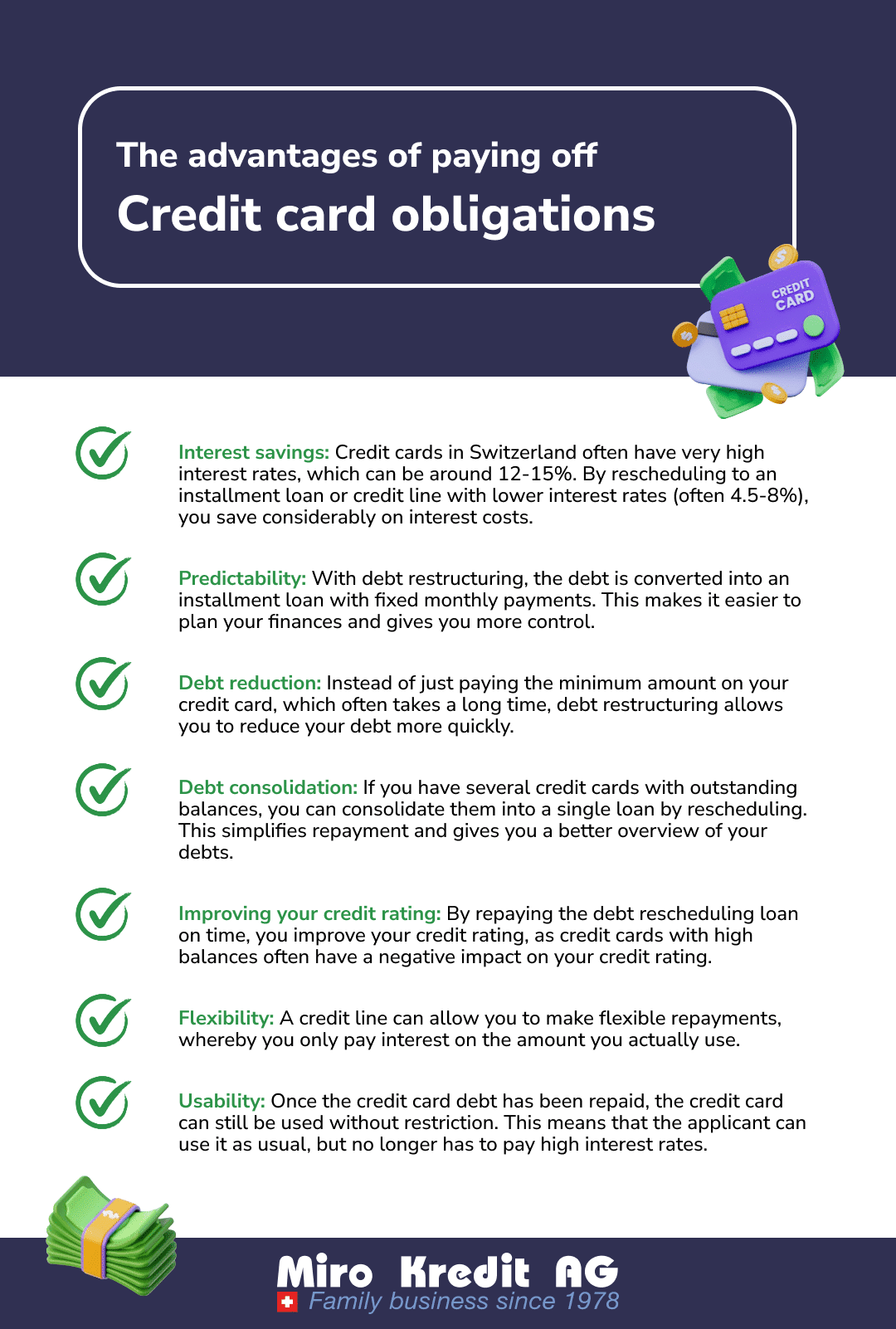

Rescheduling your credit card can help you to reduce financial burdens and save interest. Credit cards often have very high interest rates that quickly add up, especially if you only pay back the minimum amount. By rescheduling – paying off your credit card debt with a cheaper loan, such as an installment loan – you can avoid the high interest costs and benefit from lower interest rates instead.

Another advantage is that you can bundle all existing credit card debts into a single loan by rescheduling. This makes the repayment of several loans more manageable and makes it easier for you to keep track of your finances. In addition, the monthly installments on an installment loan are often fixed, which gives you more planning security. With debt restructuring, you not only create order in your finances, but also save money.

Another advantage: by paying off the credit card debt, the credit card can still be used as normal. This means that you can continue to use it as usual, but no longer pay high interest rates.

Find out about the advantages and disadvantages of credit insurance and how you can make the most of it.

The first step: get an overview

Before you start paying off your credit card debt, you should get a clear overview. List all your credit cards, including the outstanding amounts, interest rates and monthly installments. This will show you exactly how much debt you have and how much interest you are currently paying.

This will help you to find out where debt restructuring makes the most sense. You can also consider whether it would make sense to consolidate several debts to make your monthly payments more manageable. A clear overview is the first step towards reducing your credit card debt in a targeted and effective way.

Installment loan as a debt restructuring option

An installment loan can be an excellent option for rescheduling credit card debt. While credit cards often charge high interest rates of 12 to 15 percent or more, an installment loan usually offers significantly lower interest rates. This means that you can not only pay off your debt faster, but also at a lower cost.

Another advantage of the installment loan is the clear structure: you have fixed monthly installments and a defined term. This means you know exactly when you will be debt-free and can plan your spending better. In contrast to a credit card, where you can repay flexibly, the monthly installment ensures more discipline when repaying.

An installment loan is particularly suitable if you have large credit card debts that you cannot repay all at once. You can convert the debt into an installment loan and benefit from lower interest rates. Don’t forget to compare different providers to find the best interest rate and the most favorable conditions.

With a well-chosen installment loan, you can effectively reduce your credit card debt and reduce the financial burden at the same time. We can also give you tips on how to apply for a loan.

Credit line: Repay more flexibly

A line of credit offers a flexible way to pay off credit card debt. In contrast to a traditional installment loan, where you pay fixed monthly installments, a line of credit allows you to access the credit line flexibly whenever you want. You only pay interest on the amount you actually use and can decide for yourself when and how much you repay.

This flexibility can be particularly useful if you are not sure exactly how much money you need or if you want to pay off your debts gradually. A credit line also gives you the option of accessing the credit line again and again without having to apply for a new loan. This makes it a practical alternative if you want to maintain a financial cushion while you pay off your credit card debt.

Compare the interest rates carefully, as these can often be somewhat higher with a credit line than with an installment loan. Nevertheless, the credit line remains a flexible option for debt restructuring.

Replace your credit card: When is the payout made?

Once you have decided to pay off your credit card debt, the question often arises as to when exactly the debt rescheduling loan will be paid out. This is usually a fairly quick process. As soon as the loan has been approved by the bank and all the necessary documents have been submitted, payment is often made within a few days. However, the duration can vary depending on the bank, from one to five working days.

In the case of debt restructuring, the new loan is either transferred directly to your account or the bank takes over the repayment of your credit cards directly. You can then use the money you receive to pay off your outstanding credit card debt.

It is important to make sure that all the conditions of the new loan are clearly regulated and that you arrange the repayment of the credit cards correctly so as not to risk additional fees or a high interest rate. With well-organized planning, you can make the transition smooth and quickly benefit from better conditions.

FAQ

Before you pay off your credit card, there are often many questions. Here are some of the most common ones to help you better understand the process and make informed decisions.

Conclusion

Paying off credit card debt is a sensible step to avoid high interest rates and regain financial control. Whether you use an installment loan or a credit line – both options offer advantages and help you to pay off your debts faster and more cost-effectively.

It is important that you plan the process well, get an overview of your finances and compare different offers. This will allow you to choose the best path for your situation. With a clear strategy and the right decisions, the path to debt freedom is much easier to master.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.45 and CHF 523.30. Effective interest rate 4.5% – 9.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)