Applying for a loan: tips for a successful application

Applying for a loan can seem complicated at first glance, but with the right preparation, the process is not that difficult. Whether for a major purchase, a property or to finance a project – there are many reasons why a loan can make sense. However, to ensure you get the best conditions and avoid any nasty surprises, it is important to bear a few basic things in mind.

In this article, you will learn helpful tips on how to successfully apply for a loan, what you should look out for and which strategies can help you get better conditions.

Borrowing made easy: what you should look out for

Taking out a loan can be a solution for many different situations. Whether it’s buying a car, financing a home or simply bridging a financial bottleneck – a loan can give you the financial flexibility you need. To help you find the best loan and avoid pitfalls, there are a few important points to bear in mind.

You can also find out from us how you can pay off existing credit cards.

Compare interest rates: How to find the best loan

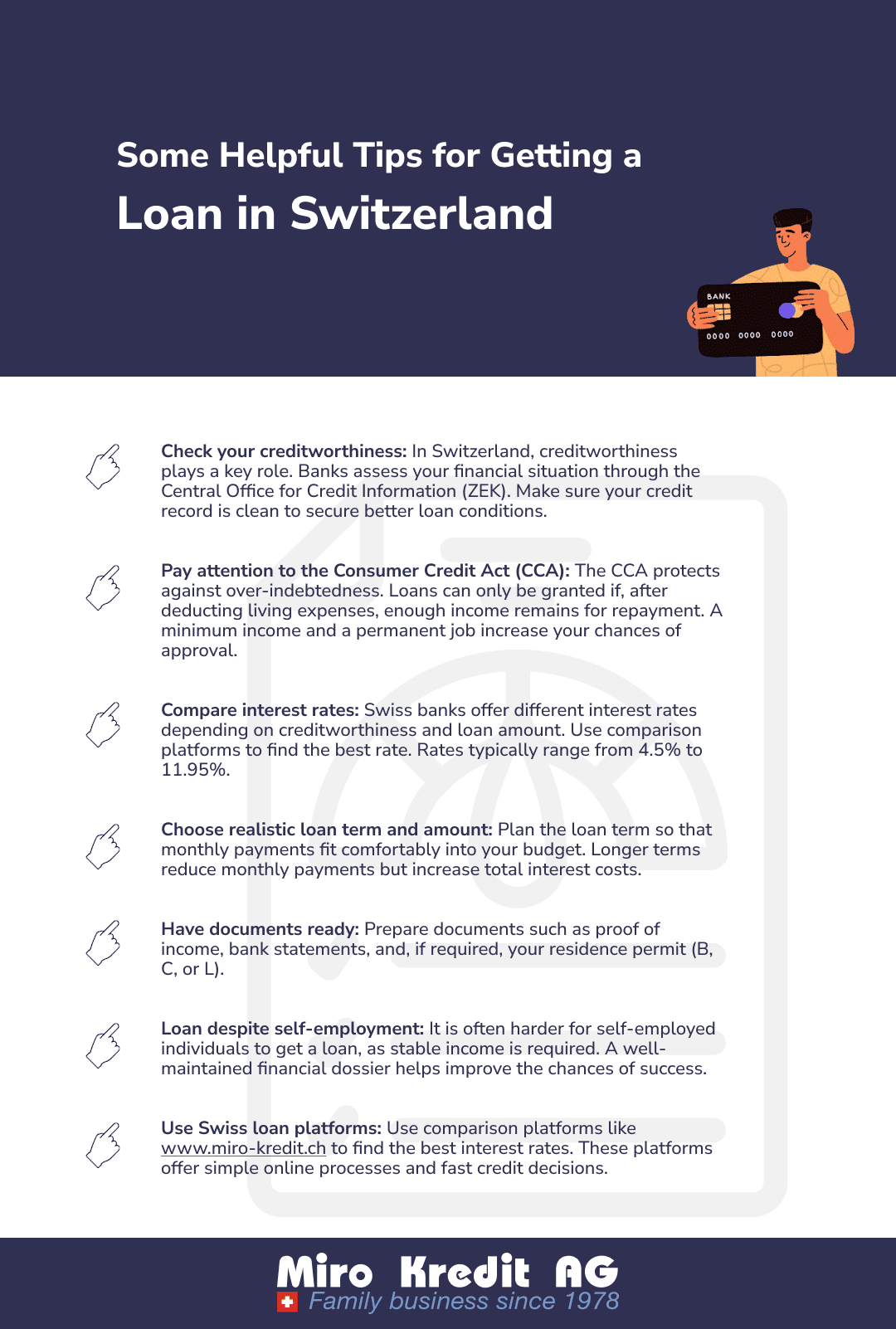

Comparing interest rates is a crucial step if you want to take out a loan. Different banks and credit institutions often offer different interest rates, and even small differences can have a significant impact on the total cost of your loan. So take the time to check the offers thoroughly and use comparison portals to find the best interest rate. Remember that the APR is crucial, as it also includes possible additional costs.

Avoid overdraft facilities: Use better alternatives

Many people fall back on the overdraft facility (or “Dispo”) on their current account when they need money at short notice. The problem: overdraft facilities often have extremely high interest rates and are therefore an expensive solution in the long term. It makes more sense to consider alternatives such as installment loans or even a short-term small loan, as these often offer significantly lower interest rates and allow for better cost control.

Choose the right type of loan: What is important for you

Not every loan is suitable for every purpose. Think about what you need the loan for in advance and choose the type of loan that best suits your plans. Whether it’s a car loan, construction financing or a classic installment loan – each type of loan has its own special features, and it’s worth comparing the conditions carefully to find the best solution for you.

We also recommend that you take out suitable credit insurance.

Strategy 1: The perfect time for the loan discussion

Choosing the right time for your loan interview can make a big difference. It is not only important to be well prepared, but also to choose the moment wisely in order to have the best chance of successfully closing the loan. But when is the “perfect” time?

First of all, you should make sure that your financial situation is stable. If your income and expenditure are in a good balance, this will make a positive impression on the bank. Avoid applying for a loan if your financial situation is uncertain or if you have just made major expenditures that put a heavy strain on your budget. Even if you have negative entries in the ZEK, it is worth waiting until these have been cleared up.

Another important aspect is the time of year. Sometimes banks offer particularly attractive conditions at certain times of the year, for example at the end of the year or at the beginning of a new financial year. It can be worth keeping an eye on interest rate developments and taking out a loan when interest rates are low.

Ultimately, the perfect time also depends on your personal plans. Plan the loan interview well in advance so that you have enough time to compare different offers and don’t have to make a decision under time pressure. This way, you are well prepared and can conduct the interview with confidence.

Strategy 2: How to present yourself convincingly in a credit discussion

A convincing appearance in a loan interview can make the difference between a standard approval and particularly good conditions. First impressions count, and it pays to be well prepared and confident in the interview. But what is the best way to do this?

First of all, you should have your finances well under control. Make sure you have all the relevant documents with you – this includes proof of income, bank statements and, if applicable, information on existing loans or other obligations. If you appear well organized, this will make a positive impression on your advisor and show that you are taking a good look at your financial situation.

Your reasoning is also important. Think in advance about why you need the loan and how you can repay it. Show that you have thought about the monthly installments and the term. A realistic and well-thought-out plan signals to the bank that you are a reliable borrower.

Last but not least: Remain calm and friendly, even when it comes to negotiations. A polite manner combined with a clear understanding of your financial situation is often more convincing than frantic attempts to negotiate better conditions. In this way, you will appear confident during the loan discussion and increase your chances of a positive outcome.

Strategy 3: Use expert advice for better conditions

Seeking expert advice before you apply for a loan can help you to obtain significantly better conditions. Financial advisors or loan brokers often have years of experience and know the best offers and options on the market. So why not benefit from this knowledge?

Miro Kredit AG can help you to objectively assess your financial situation and show you which types and amounts of credit are realistic and sensible for you. This can be particularly beneficial if you are unsure which conditions are best suited to your situation or how you can optimize your application. We also have access to special offers or better conditions that you might not immediately find as a private individual.

Our experts can also help you avoid typical pitfalls. They know exactly what banks pay particular attention to and how you can maximize your chances of a successful application. When negotiating with the bank, it can also be useful to have someone at your side who speaks the language of credit institutions.

Strategy 4: Start the loan discussion well prepared

Expert advice can often lead to better conditions when applying for a loan. For example, Miro Kredit AG offers comprehensive advice and supports you in realistically assessing and improving your creditworthiness. We help you to prepare the necessary documents correctly and point out potential pitfalls when applying for a loan, such as the importance of creditworthiness and credit capacity.

Sound advice ensures that you not only get the best possible interest rate, but also a loan amount that suits your financial situation. In addition, experts can often point out specific loan offers or solutions that you might have overlooked yourself.

It is therefore worth using an advisor such as Miro Kredit to ensure that you get the best possible loan at the best possible conditions.

We can also tell you everything you need to know about minimum age loans, which plays a major role when applying for a loan.

FAQ

Before you apply for a loan, there are many questions that should be clarified. There are often uncertainties regarding the requirements and conditions that banks and credit institutions demand. To give you an overview, we answer the most frequently asked questions about loans here. This way, you are well prepared and know exactly what is important in order to successfully apply for a loan.

Conclusion

To sum up, a successful loan application depends on good preparation and the right strategy. By keeping an eye on your finances, comparing the best offers and going into the loan interview well prepared, you significantly increase your chances of obtaining a favorable loan.

You can also use the expertise of financial advisors to achieve even better conditions. Timing and your appearance during the interview also play an important role. With these tips, you are ideally equipped to apply for a loan that perfectly suits your needs and does not overburden you financially.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.45 and CHF 523.30. Effective interest rate 4.5% – 9.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)